by Kevin Janiec CFP®, MBA

2021 was a unique year with all kinds of societal, economic, and market-related phenomena.

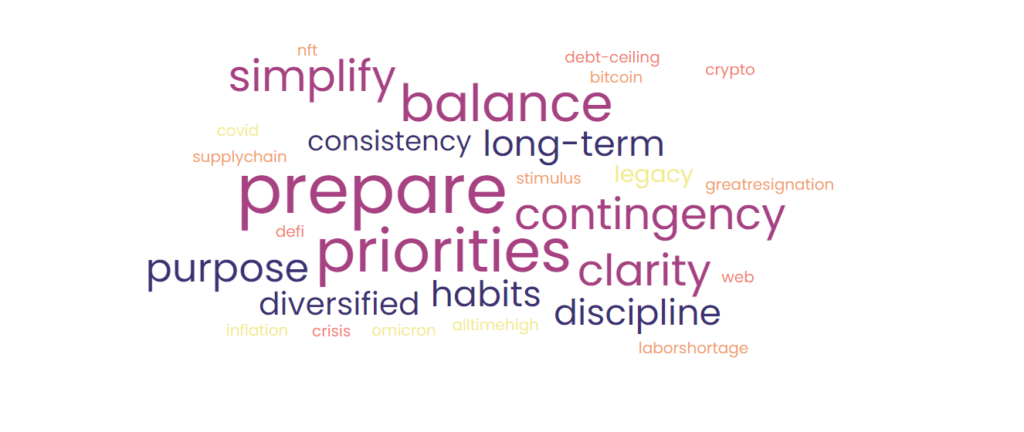

With the rollout of COVID vaccines, we returned to quasi-normal lives that were shaped by new protocols and altered by new variants. Many changed jobs during the “Great Resignation.” We saw changes in government and rode the roller coaster of a weird economy that brought us historical supply shortages, rampant inflation, low interest rates, and yet repeatedly “All time highs” in the stock market. We know high school classmates and neighbors that got rich from investments in Bitcoin, MEME stocks, or NFTs. And instead of talking about the Cowboys at Thanksgiving Dinner, the topic of conversation was centered around Crypto, gas prices, and Omicron.

But before all of the scary headlines and confusing information of 2021 overstimulates your human psyche and causes fear, greed, or paralysis in 2022, let’s take a moment to revisit your personal priorities. Because the economic concepts that we all get excited about or worried about have no meaning without the context of how they impact our own personal situation.

And from what we’ve seen with our own New Wealth Project (NWP) clients, the priorities that they cared about and planned for in 2021 remain very similar to the goals they look forward to in 2022. So why should the time-tested investment, asset protection, and savings principles be any different heading into next year?

For example, the expressed desires on NWP Vision Link Reports often include an inviting home and fulfilling career, the financial flexibility to “say yes” and create memories with friends and family, and the ability to offer valuable opportunities and experiences for their children.

So to achieve and sustain those expressed desires this year, NWP clients did a few things that worked in 2021 and will continue to work in 2022.

- NWP clients prepared for family emergencies, employment contingencies, and all economic conditions with the assets that they have.

- They established a cash flow system to balance living for today while also doing right by their future selves.

- They carved out occasional time from their busy lives to discuss their upcoming priorities, seek professional guidance, and implement simple yet necessary adjustments.

- They remained open-minded and curious about new investment opportunities and mind blowing economic phenomena, but found confidence, reassurance, and discipline in the plan that they made and the habits they committed to.

- They enjoyed the growth that they’ve seen in their careers, families, and portfolio balances, but remained humble that market corrections and life events are inevitable and unpredictable in the future.

How are you feeling heading into the new year? When the champagne pops and the Times Square ball drops, will you be concerned about inflation? Curious about Crypto? Uneasy about what will happen with interest rates and the stock market? Worried about Omicron or climate change? Excited about a new job or an upcoming home renovation? Anxious about a new child on the way?

2022 will likely be a year of new phenomena as well. But as long as your priorities stay relatively similar, your principles for achieving those priorities will be the same. Maybe this will be the year that you find your own Vision Link Report and corresponding financial plan. Don’t hesitate to reach out if you’d like some help with it.

Until then, we wish you a healthy Holiday season, a merry Christmas, and a happy New Year!

Investment Advice offered through FC Advisory LLC, a registered investment adviser doing business as “New Wealth Project” and as “Financial Coach”. This content is provided for informational purposes only. Views and opinions expressed are those of the authors and do not necessarily reflect those of FC Advisory, LLC. Information provided is not and should not be interpreted as investment, tax, legal, or other professional advice or recommendation by FC Advisory, LLC or the members of our firm. Always consult the appropriate professional regarding your specific situation before implementing any options presented or inferred. FC Advisory LLC, All rights reserved.