Kevin Janiec, CFP®

My niece and nephew spent their spring break on a college tour through the Carolinas.

I loved hearing about their experience at universities like Clemson, University of Charleston, and Wake Forest. The tour gave them a better feel for their preferences. Since they’re only going into their junior and sophomore years, they still have plenty of time to explore, improve their transcripts, and narrow down their options.

But for parents like my brother/sister-in-law, this serves as a critical time to assess and discuss how they plan to pay for this expensive next chapter. It’s also important to determine what guardrails they’ll put around selection, and the amount of “skin in the game” they’ll expect from each child.

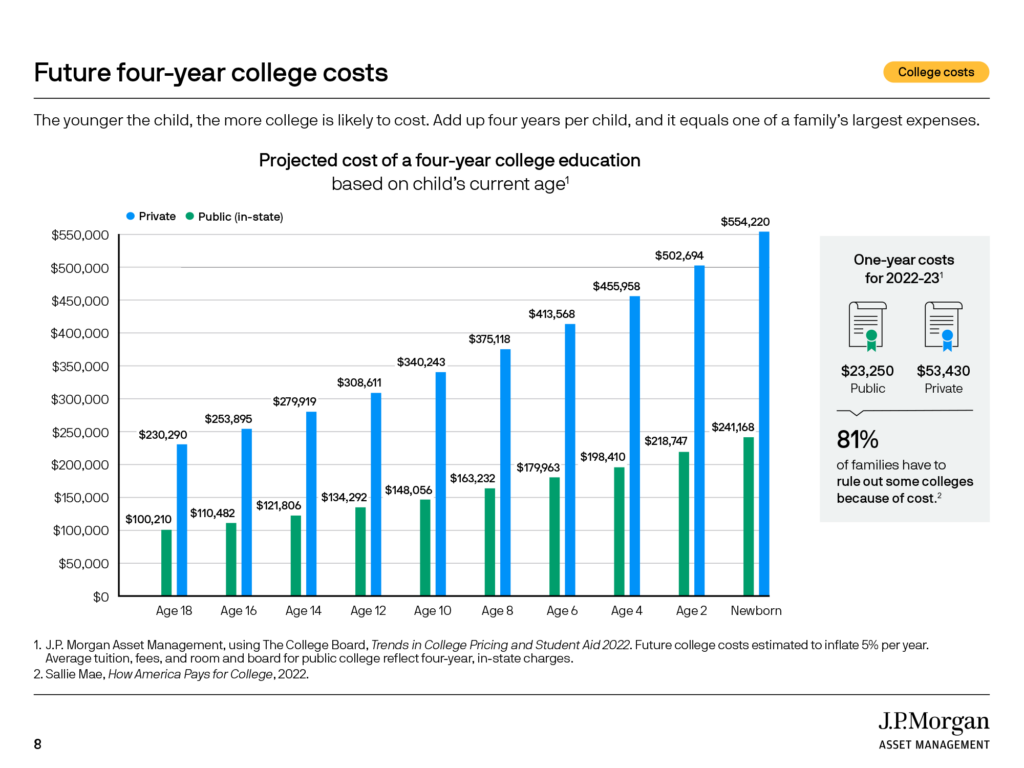

Depending on the school, the size of the bill after grants and scholarships, and the number of kids in the family that plan to go to college, the cost of education can range hundreds of thousands of dollars. This seems to be one of the most pivotal decisions that New Wealth Project clients make. Because a bigger tuition tab than planned for can mean:

- Delaying retirement by several years

- Limiting current and future lifestyle

- Increasing pressure on the household’s cash flow

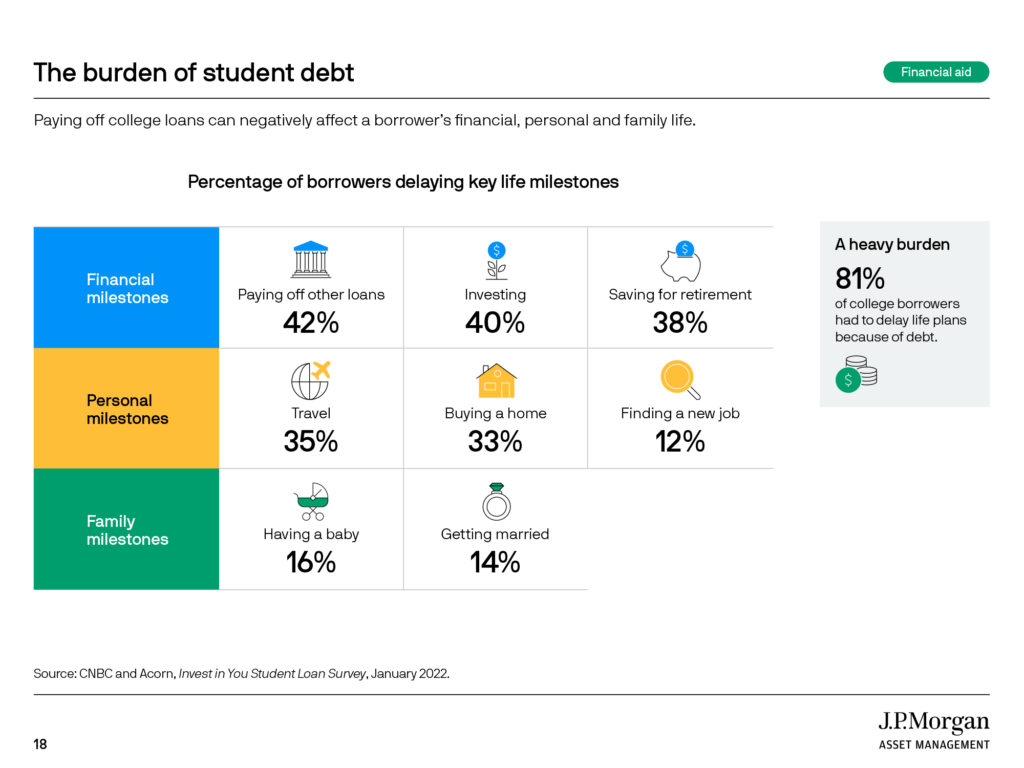

- Burden kids with a hefty student loan balance that can delay moving out, career flexibility, and other future life goals.

These consequential delays happen after a combination of the following takes place:

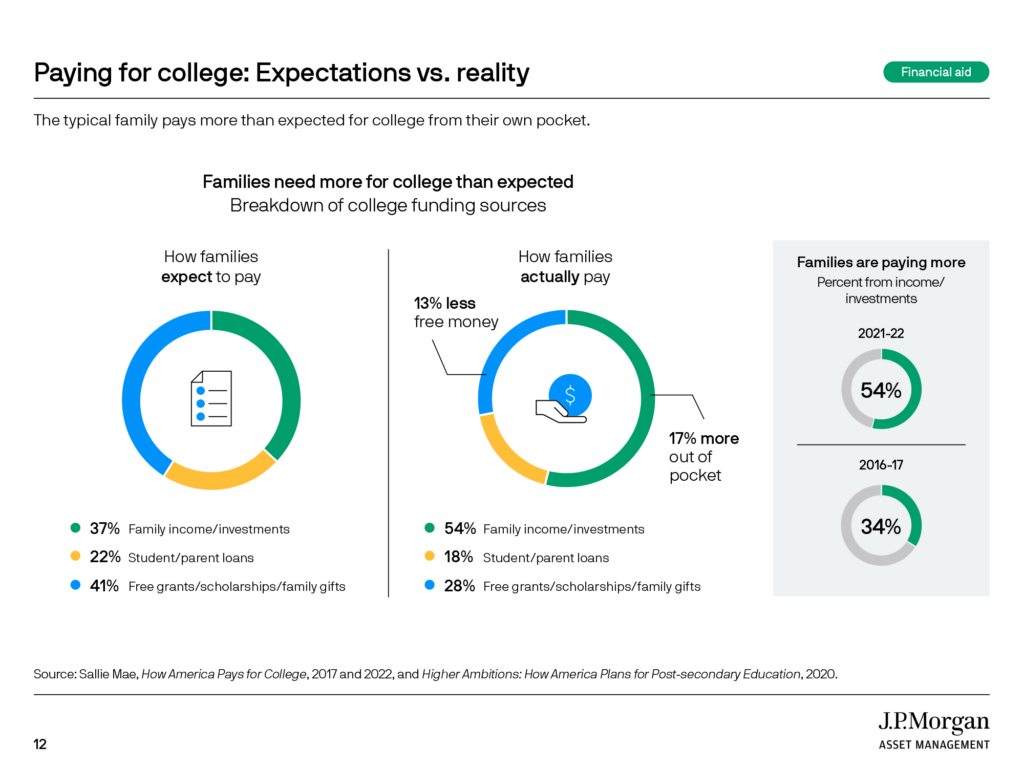

- Insufficient savings are earmarked for college in the appropriate investments/accounts.

- Parents are unclear what education costs they can afford within their financial plan.

- Parents don’t put parameters or limiting factors around which school their child selects.

- Unclear communication about how college will be paid for and the implications that will result for the parties that are paying for it.

When this sequence happens and a student selects an unaffordable school, parents are left with a predicament: Do we pull the plug on our child’s dream school after they already bought the sweatshirt or just “figure out a way” to pay for it over time?

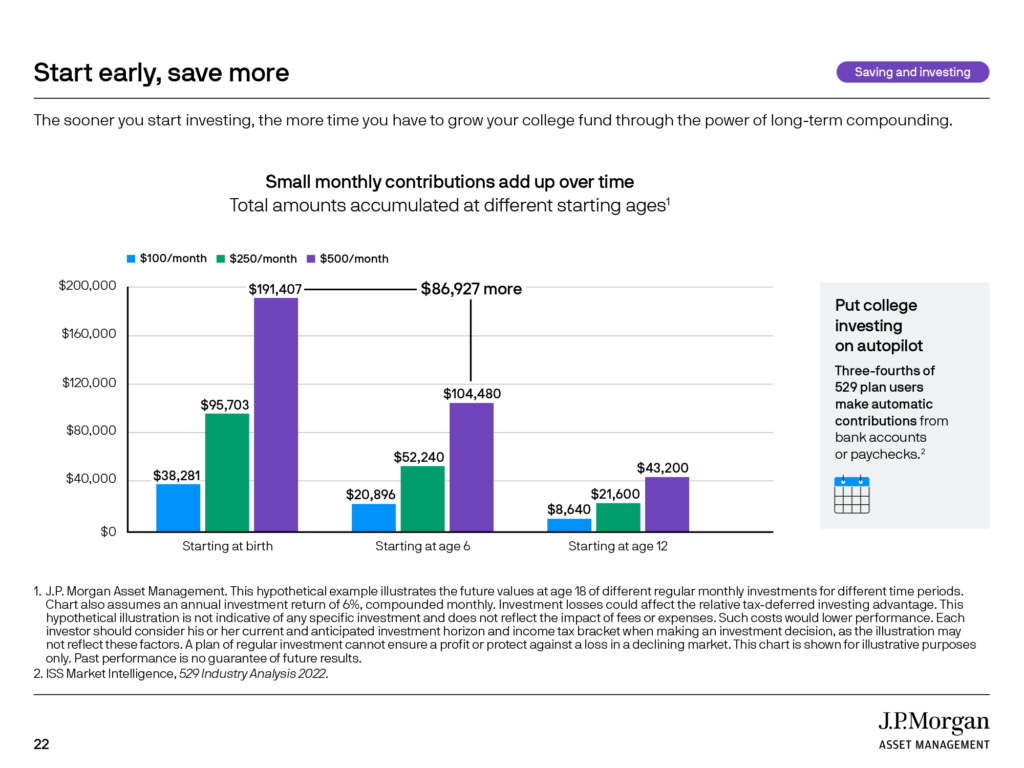

The New Wealth Project helps parents establish a savings plan and selection approach that allows their child to pursue higher education without derailing other life goals. The earlier parents start investing for a goal like this, the more options they have when they make this choice. The more proactive parents analyze and talk through their selection criteria, the better their choice tends to be. We’re here to help initiate and facilitate these conversations while using various planning tools and insights to make sense of the math.

We’ve seen high school graduates attend community college, trade schools, in-state public schools and out-of-state private schools – and we’ve seen thrilled parents and successful students on each of those paths. We just encourage our clients to lean into those choices with:

- An education budget that fits within their broader financial plan.

- A student loan cap for each child and discussions with each child about the implications of taking on student debt.

- The potential price tag of each school on the list and aid required from each school to make it budget eligible.

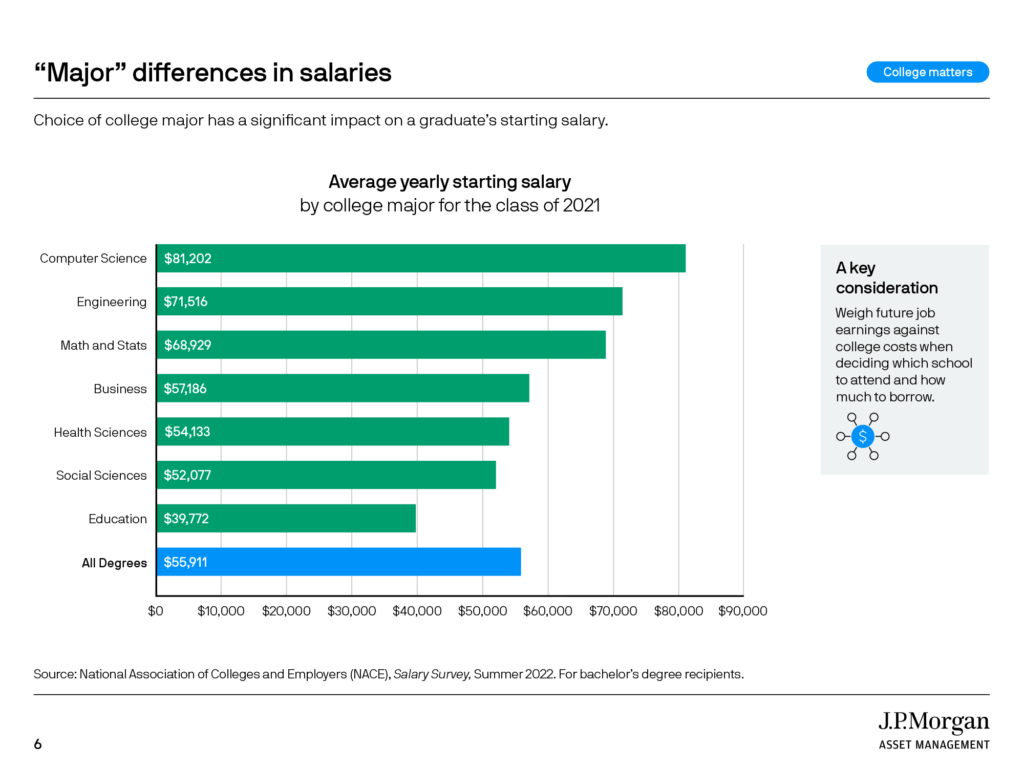

- Clarity of the other qualitative factors that are encouraged/discouraged in the selection (location, field of study, size of school, reputation, etc.)

I’m excited for my niece and nephew in this next chapter, and I’m confident they’ll listen to their Uncle Kev on this one. See you guys at the tailgate!

As for everyone else, schedule a Personal Mission Builder to have this conversation and prepare for this decision before it’s too late.

This content is provided for informational purposes only and is not intended as, nor does it substitute for personalized investment advice from FC Advisory, LLC. The views and opinions expressed are those of the authors and do not necessarily reflect those of FC Advisory, LLC. Always consult the appropriate professional for questions regarding the applicability of any specific issues discussed or inferred.

The hyperlinks provided in this communication are to external websites which are owned and operated by non-affiliated third parties. If you use these hyperlinks you will leave our website; we bear no responsibility for the accuracy, legality, or content of these external sites or for that of subsequent links. No warranties or representations are being made about linked websites, the third parties they are owned and operated by, the information contained on them, the accuracy, completeness, or timeliness of their content, or the suitability or quality of any of their products or services.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk and there can be no assurance that the future performance of any specific investment, strategy, or product will be profitable, will equal any corresponding indicated historical performance levels, or be suitable for your portfolio. Due to various factors, including changing market conditions, this content may no longer be reflective of current opinions or positions.

Investment Advice offered through FC Advisory, LLC, a registered investment adviser doing business as Financial Coach and also doing business as New Wealth Project.